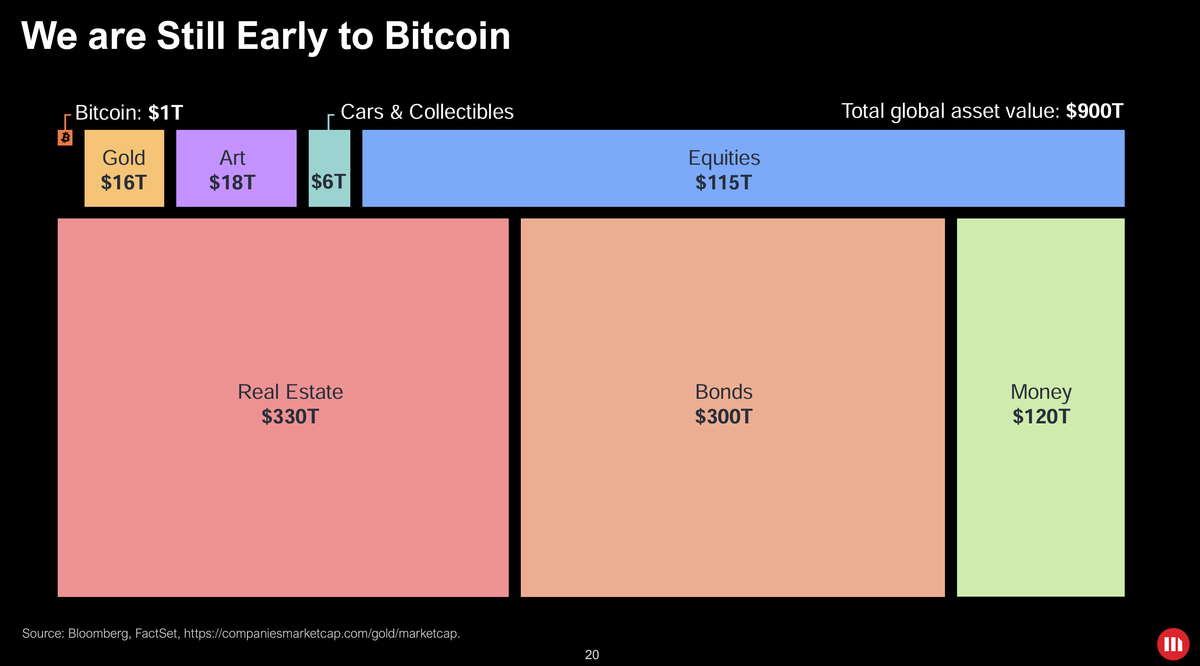

Why We're Still Early: Bitcoin's $1 Trillion Market Cap in a $900 Trillion World

Bitcoin is receiving recognition from both retail investors and financial institutions. The graphic "We are Still Early to Bitcoin" shows a visual comparison of Bitcoin's market value with other major global asset classes. This chart helps us understand Bitcoin's place in worldwide wealth distribution and why it remains an early opportunity. The cost is often seen as too high because it has risen so much since 2009, but some argue "everyone gets the Bitcoin price they deserve" and we are still in a beginning stage.

The Global Asset Landscape

The total worldwide asset value is more than $900 trillion. This huge sum is divided into different types of assets like real estate, bonds and money; equities such as stocks in companies or other businesses; precious metals such as gold; valuable paintings or sculptures (art); and expensive cars & collectibles.

Having a market cap of more than $1.25 trillion (Bitcoin Price Real-Time), Bitcoin is only one part of the financial world. Yet it's very significant and important. Bitcoin was created in 2009 and has been noticed for its rapid growth, surpassing the performance of regular assets in return over these past ten years. In the world of investment, it is acknowledged by professional investors that even a small inclusion of Bitcoin in a portfolio can enhance its performance that is adjusted for risk. This results in an increase of what we call the Sharpe ratio.

Early Adoption and Growth Potential

Bitcoin is not as widely embraced as conventional assets such as bonds or real estate. The following points provide possible reasons why this could be seen as a positive for those holding or buying Bitcoin:

- The digital currency market is growing quickly, and Bitcoin's value has been consistently rising over time.

- Many big companies and famous investors are showing interest in Bitcoin, which can boost its acceptance by the mainstream.

- As more people start using Bitcoin, it may become a better store of wealth due to its limited supply.

- If governments introduce more rules regarding money printing or other economic policies, it could lead to an increased interest in decentralized currencies like Bitcoin.

- Some people believe that if the global economy becomes unstable or there's a financial crisis, Bitcoin might act as a safe haven asset similar to gold. These points indicate that while Bitcoin still must overcome challenges related to security and regulation before being fully accepted by society at large – this particular time frame might be viewed with anticipation because of its potential for value appreciation along with worldwide adoption benefits.

- The volatility of bitcoin prices can be extreme at times but some individuals see this characteristic as an opportunity.

Market Penetration:

Bitcoin's market share is very small compared to other assets. With a market cap of over $1.25 trillion, Bitcoin only makes up 0.11% of the total worldwide asset value. This means there's plenty of space for growth as more people start using it. Most individuals still don't comprehend Bitcoin well enough and many US investors don't find a necessity in utilizing this cryptocurrency yet. However, it is more obvious to those residing in countries with notable inflation, a less stable banking sector, and capital controls (e.g., Egypt, Nigeria, El Salvador, Argentina, Greece, etc. ).

Institutional Investment:

Interest from institutions in Bitcoin has grown a lot in recent years due to increased awareness and approvals for ETFs. The newly approved Bitcoin ETFs own nearly 5% of the total 21M supply. Large companies, hedge funds, and even countries include some part of their portfolio with Bitcoin. Satoshi understood Bitcoin's capacity to be a reservoir of value and safeguard against inflation. For illustration, Microstrategy has acquired more than 214K Bitcoin via convertible note sales of its stock (MSTR), Tesla (TSLA), Block (SQ), and others with substantial stakes in this currency. El Salvador is involved in mining and keeping Bitcoin at the sovereign level, an action that will probably be copied by numerous other countries soon enough.

Technological Innovation:

The basic blockchain technology, which backs Bitcoin, is growing and improving. Bitcoin has been updating since its creation in 2009 without problems; it processes blocks (transactions on the ledger) every ten minutes. At the time this article was written, we are nearing the completion of the 850,000th block.

Developers are trying to make Bitcoin more usable by everyone, and AI is predicted to assist with this. Currently, Bitcoin is too technical for most individuals, but companies such as Block and Strike intend to simplify it for the average user.

Government & Regulatory Environment:

Though there is still difficulty with regulatory uncertainty, the direction is towards more embracing and inclusion of Bitcoin within the financial system. You have senators like Elizabeth Warren with her anti-crypto army, but over 50 million US citizens own Bitcoin, and they want clear regulations. This creates a possible base of single-issue voters that could change the outcome of a presidential election. Under Biden, SEC/Gary Gensler are litigating vs providing rules, which has become a very unpopular policy. Clearer regulations might help to lessen the perceived risks of Bitcoin investments and make it easier for more people to accept.

JUST IN: 🇺🇸 Donald Trump says he will "ensure the future of crypto and #Bitcoin will be made in America."

— Bitcoin Magazine (@BitcoinMagazine) June 15, 2024

"We're gonna keep it right here." 👏 pic.twitter.com/LZLq1QLwk1

Comparative Analysis of Asset Classes

To comprehend Bitcoin's endurance, we need to examine more about the features and past performance of other kinds of assets.

Real Estate:

The largest asset class is real estate, having a total worth of $330 trillion. People commonly view it as a stable investment because it holds genuine value and frequently generates money via rent. Yet, investing in real estate requires substantial capital, might not be easy to convert into cash (known as illiquid) quickly, and entails numerous costs for its maintenance and payment of taxes on the property. Normally, taxes are typically about 1% to 2% of the real estate value. Therefore, after 25 years it's similar to paying roughly half or 50% of your property's worth in tax.

Bonds:

Investments in bonds of $300 trillion are often looked upon as low-risk investments providing regular returns. These types of investments are usually favored by investors who desire stability and are not willing to take on high risks. Nonetheless, if interest rates stay very low then the amount you gain from bonds could be somewhat more than inflation. There has been a big impact on bond returns, with some of the worst results in history as the Federal Reserve raised rates in recent years.

Money:

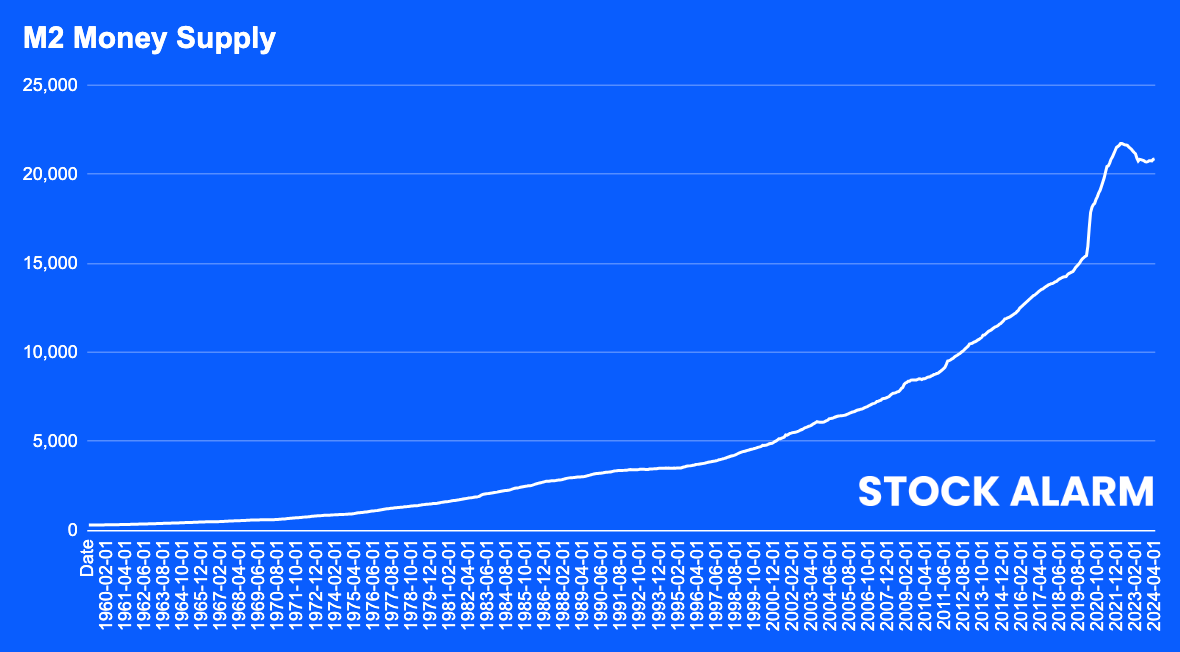

The total sum of money, counting both cash and near-cash things, stands around $120 trillion. The liquidity and security offered by cash are undeniable yet it fails to yield any returns. Furthermore, this money might lose its purchasing power because of inflation. Many governments worldwide are printing more money which is pushing up prices resulting in a rise called "inflation". Regarding the M2 money supply, it has grown a lot in the United States and currently totals over $20 Trillion. With this increase in dollars, the Federal Reserve feels compelled to raise rates to fight inflation. This will make the interest expense on federal debt go up and put the Fed in a tough spot.

Equities:

You can buy shares in companies to get exposure to the $115 trillion stock market. These investments can make you a lot of money, but they can also go up and down and can be risky. To get the most out of your stock market investments, you need to do your homework and plan carefully. The "Magnificent 7" stocks have been the big winners over the last several years and decade, pushing the market up, but many other stocks haven't moved as much.

Gold:

Gold has a market cap of $16 trillion. Many investors utilize gold as an inflation hedge. Investors such as Peter Schiff still strongly advocate gold compared to Bitcoin. Those who support Bitcoin debate that gold is difficult to move, it costs a lot to transfer and if prices go up its supply can grow too - these factors make it less appealing than this digital currency.

The Future of Bitcoin

The market cap of Bitcoin is still not very high relative to other asset classes. As people continue to use Bitcoin in different ways like sending money across borders, saving value or investing it shows the acceptance this digital currency has gained within society. The supply of Bitcoin is affected by the creation or "mining" of new coins. Every four years around, this " halving " process cuts in half the reward given to miners. Bitcoin, a digital currency with fixed supply (only 21 million bitcoins will ever be mined), might see its value grow when more people want it and there is scarcity. The stability of bitcoin's price may improve as liquidity rises.

Bitcoin Rules

Michael Saylor, a famous Bitcoin investor, has been purchasing Bitcoin for some years using his company's balance sheet (Microstrategy). Here are the "21 Bitcoin Rules" that he has assembled to assist people in comprehending this kind of asset class and how it operates practically. Michael possesses a degree from MIT and is a rocket scientist. So you might want to pay attention to what he has to say:

21 Rules of #Bitcoin pic.twitter.com/lhKPqtPOmc

— Michael Saylor⚡️ (@saylor) June 18, 2024

In conclusion, the journey of Bitcoin from a cypherpunk trial to a recognized asset class is just starting. Its market cap of $1 trillion appears big, but it's still minor in relation to total wealth worldwide, which shows there's more space for future growth and approval. Whether you are a seasoned investor or newcomer in the bitcoin market; it becomes crucial to understand where this digital currency fits within global assets sphere before making any investment choices.

Disclaimer

DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. We are just a group of students who diligently follow industry trends and current events, then share our own advice, which reflects our personal position in the market.